Mortgages and finance > Self build mortgage

Secure your self build mortgage

Discover how much you can borrow, calculate your project costs, and take the first step toward funding your self build. We offer access to essential tools, including the free self build mortgage guide, and can help to make your project a reality.

What is a self build mortgage?

A self build mortgage is a type of loan designed specifically for people building their own homes. Unlike traditional mortgages, where the full amount is given upfront, self build mortgages release funds in stages as your project progresses. This ensures you only pay interest on the money being used.

You can use our self build mortgage calculator to find out how much you could borrow and manage your project's costs effectively.

How do self build mortgages work?

Both self build and custom build mortgages release funds in stages, as your project progresses, rather than providing a lump sum upfront. We’ve broken down how they work and what you can expect.

A typical self build mortgage requires a 20% deposit against the total project cost (land and build), though deposits can go as low as 15% with certain lenders.

You can choose between funds being released in advance or after each stage, depending on your project’s cash flow needs.

Use our self build mortgage calculator to estimate how much you could borrow and calculate your project costs.

You’ll only pay interest on funds currently in use during the build.

Most lenders allow a switch to a standard mortgage post-build, often without early redemption penalties.

Funds are available to buy land, as long as the plot has at least outline planning permission or permitted development rights.

If you already own land and have planning approved, you could finance up to 100% of your build costs.

The stages of fund release vary by lender and construction method, so we’ll guide you on the best fit for your project.

The full loan amount is agreed at the start, with funds released in line with the build’s progress.

Interest-only payments are available during the build to help manage costs.

Lenders will want to ensure the loan and any savings cover all project costs, including a contingency, through to completion.

How much can I borrow on my self build mortgage?

Use our self build mortgage calculator and get a quote for your lending within 2 minutes

How much is it going to cost me to build my own house?

Find out in 2 minutes exactly how much your build will cost. Use our free online build cost calculator

What fees will I have to pay on my self build mortgage?

When arranging a self build mortgage, there are several fees involved throughout the process. While the interest rates are often comparable to standard mortgages, there are other costs specific to self builds.

Mortgage interest rate

This is currently similar to standard mortgage products.

Valuation fee

Covers the cost of valuing your property during the build.

Conveyancing costs

For handling the legal aspects of your mortgage.

Warranty insurance

Required to protect your build.

Site insurance

Ensures your project is covered during construction.

Lender product fee

Some lenders charge a fee for their mortgage product.

Broker fee

Covered by our money-back guarantee.

Stage release re-inspection fees

For each inspection when funds are released in stages.

Why is it hard to get a self build mortgage?

Getting a self build or custom build mortgage can be more challenging than a traditional mortgage because fewer lenders offer these products. Unlike buying a completed property, self build mortgages involve more complex requirements. But understanding these key points can help you navigate the process.

Fewer lenders offer self build mortgages compared to traditional property loans, and major high street banks typically don’t provide them.

Each self build mortgage lender requires a detailed cost report, including contingencies, which vary by lender.

Self build mortgage lenders agree on your loan amount upfront but release the funds in stages. A cashflow forecast is needed to ensure their payment schedule fits your project.

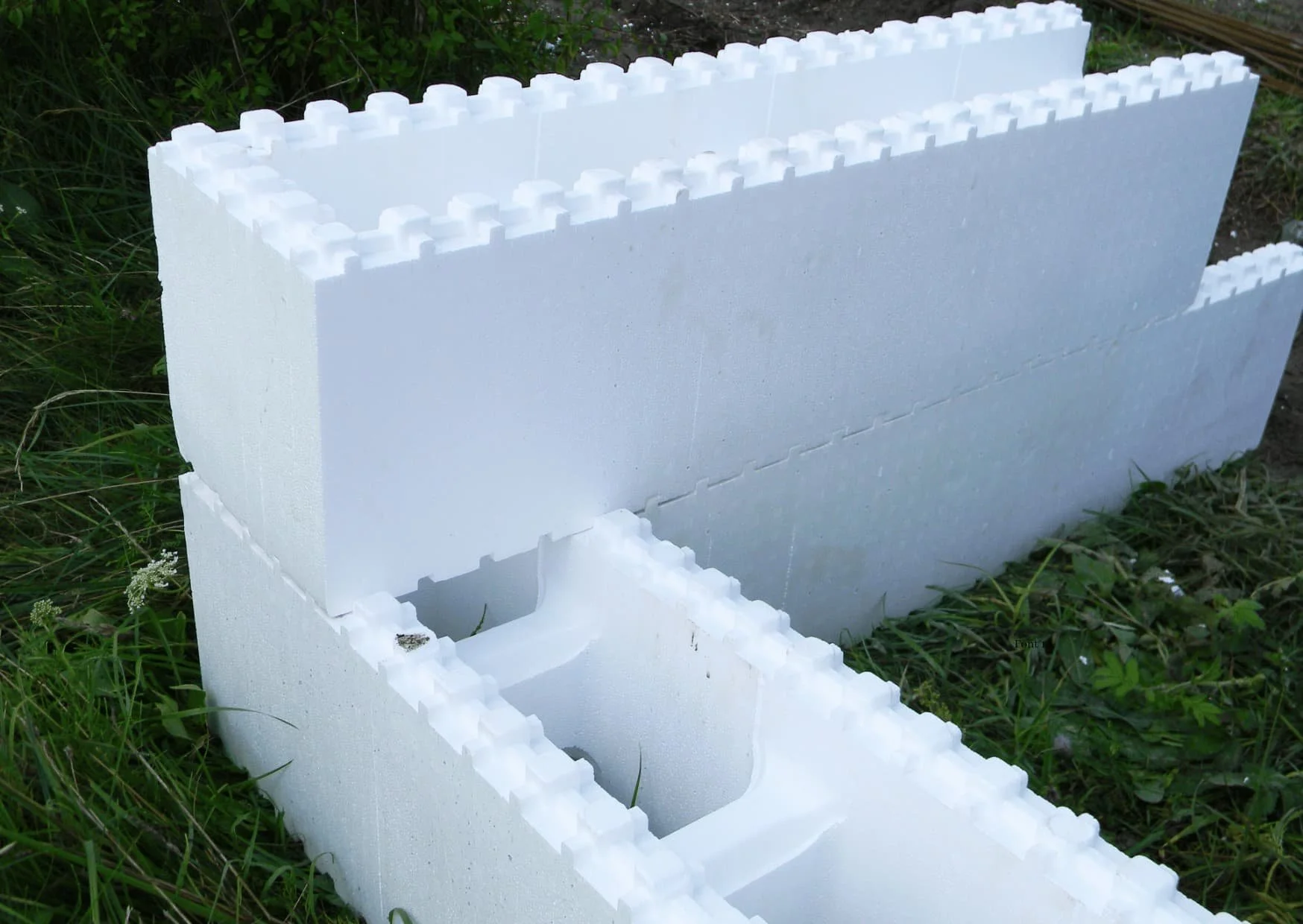

Lenders require detailed plans for the construction, including information on materials, structure, and certification.

Your involvement in the project will be assessed—some lenders allow full DIY involvement, while others have restrictions based on your build and personal circumstances.

Specific build insurances, such as site insurance and structural warranties, are required, with different lenders accepting different providers.

Our self build mortgage success stories

When will funds be released from my self build mortgage?

Funds are released at key project stages, ensuring you have the financing needed for each major phase — from land purchase through to final finishes. The different stages in your self build project will depend on the draw downs specific to your own custom build. The most common examples of stage drawns on a self build mortgage are bricks and block and timber frame.

Bricks & blocks

Land purchase (or remortgage if already owned)

Preliminary costs & foundations

Wall plate level

Wind & watertight

First fix & plastering

Second fix to full completion

Timber frame

Land purchase

Preliminary costs, foundations & frame purchase

Frame erected on site

Wind & watertight

First fix & plastering

Second fix to full completion

Latest Self Build Mortgage Rates

The example self build mortgage rates displayed on this website are for illustrative purposes only and are based on current market conditions as of the date 12/03/2025. These self build mortgage rates are subject to change without notice and may not reflect the most current self build mortgage rates available. The actual self build mortgage rate and terms you may be offered will depend on your individual circumstances, including but not limited to your credit rating, loan amount, loan-to-value ratio, construction type, your involvement with the project management and cash flow requirements. The Fees noted have been calculated using a self build mortgage loan of £250,000, fees may vary.

Why choose Mayflower for your self build mortgage?

Personal support from start to build completion.

FREE build report and 3D images worth £1,700.

5-star rated service from satisfied clients.

Access exclusive client discounts with the Self Build Savers Solution.

Get mortgage products only available through Mayflower.

Work with experts in self build construction finance.

FREE access to industry-leading procurement software.

NaCSBA Gold Partner adhering to top industry standards.

We’re award winners!

You can join hundreds of people trusting Mayflower with their self build mortgage every year

We understand your self build journey

Mayflower was born after our two directors, Mike and Lulu, embarked on their own construction project and found the self build mortgage process complex and confusing. Now, with over a decade of experience, we help to help make self build mortgages easier to navigate and offer tailored solutions that take the stress out of financing your build.

Want a FREE guide to master every step of your self build?

Our Complete Self Build Encyclopaedia is your ultimate guide to creating the home of your dreams. With 100,000 words of expert advice on everything from land acquisition and eco-building to planning permissions and project management, this FREE encyclopaedia gives you the answers you need, all in one place.

Can I claim back the VAT on my self build?

Andrew Jones (A.K.A The VATman) specialises in VAT reclaims for new builds and conversions. We’ve partnered with him to create a show guide covering how you can reclaim VAT when creating or converting a new home for yourself. You can download the guide now to help make the most of your budget.

Mayflower mortgage and finance do not give tax advice and any information or advice is directly from the THE VATMAN

How can we support your self build journey?

Frequently asked questions

-

A self-build mortgage is a tailored loan for those constructing their own homes, releasing funds in stages as the project progresses. This phased approach allows you to only pay interest on funds when needed. Use our self build mortgage calculator to get an estimate based on your project’s needs.

-

Unlike traditional mortgages, self-build and custom-build mortgages release funds in phases as you complete key construction milestones, ensuring you only borrow what’s required when you need it. You can book a call with our team of experts to better understand the process and how we can support you.

-

Borrowing limits vary, as lenders assess your income and project costs. For an estimate based on your situation, try our self build mortgage calculator to see what you might qualify for.

-

Yes, it’s often possible to remain in your current home during the project, but this depends on your financial circumstances and borrowing limits.

-

Yes, you can but land without planning. But for the land purchase we would need to use an alternative funding method as planning permission is required for self build financing.

-

Yes, self build mortgages are accessible to first time buyers, providing they meet the lender’s criteria.

-

Yes, retirees are eligible, but lenders will review factors like income and project costs to determine eligibility. You can book a call with our team of experts to talk through your specific circumstances.

-

Bad credit doesn’t necessarily disqualify you from a self build mortgage. Lenders will review your credit history and assess on a case-by-case basis.

-

Currently, many top high street banks don’t offer self build or custom build mortgage products. Our team can match your project to specialised lenders that support self build projects. Contact our team to find out which lenders would suit your project requirements.

-

If you own the land, you may not need a cash deposit. This is dependent on your self build project cost and estimated final value, but you could potentially fund the entire build with your self-build mortgage.

-

Self-build mortgage terms align with regular mortgages, with the term typically extending until your primary income stream stops or your project’s cash flow ends.

-

Self-build mortgages generally use a repayment structure, meaning your debt will be fully repaid by the term’s end, similar to a traditional mortgage.

-

Usually, a 25% cash deposit on the total project cost is standard, though if you already own land, the required deposit may be lower. Read more about deposits for self builds in our self build mortgage blog.

-

Budgeting for a self build mortgage involves careful planning and considering several factors that can impact the total cost. We recommend breaking this into four parts:

1. Land cost: The price of the land you’ll build on, if you don’t already own this.

2. Build costs: Research average build costs per square meter in your area, or use our build cost calculator to get a more specific estimate based on the size and features of your home.

3. Contingency plan: Include a buffer of 10-20% in your budget, or allow for additional borrowing on your self build mortgage, as a contingency for unexpected costs that may arise during construction.

4. Lender borrowing limits: Most self build mortgages allow you to borrow up to 75% of the total project cost. Use our self build mortgage calculator to get a quote for how much you could borrow.

-

Applications typically take 8-12 weeks, depending on the lender’s process and requirements. Your adviser can provide a timeframe tailored to your selected lender’s process once you have the ideal lender in place.

-

Self-build mortgage rates can vary, often higher than conventional mortgages due to the phased release of funds. Check our up-to-date rates (further up this page) for current figures.

-

Traditionally, self build mortgages would be released in 5 stages, being foundation, wall plate, wind and watertight, first fix, and second fix to completion. But many lenders today allow flexible drawdowns based on your project’s timeline and inspection needs. As each self build mortgage lender has different criteria on the amount of draw downs they will allow, your adviser will ensure that the self build mortgage lender you’re paired with will allow the expected number of inspections you need on your mortgage.

-

Self-build mortgages can have higher interest rates due to the phased nature of payments. You can check our up-to-date rates (further up this page) to get a sense of the costs.

-

Alternative funding options include refinancing existing property, savings, and development loans. But if you plan to live on the land post-construction, a self build mortgage could be the most cost-effective option. Book a call with our team of experts to talk through your options.